A better approach to building financial systems

With financial systems, your applications need to be rock solid and should just work. But you still need to handle the increasingly complex landscape of regulations in an industry that can be local, regional, or global, often all at the same time. In short, you need an approach to system architecture that is reliable, resilient, and flexible. After all, you're dealing with the world's money.

Learn how, by building a system with NServiceBus and the Particular Service Platform, you will be able to:

- Protect mission-critical data by building a system with reliability baked in.

- Integrate easily with multiple external systems.

- React in real-time to a demanding client base.

- Handle a complex domain that is ever-changing.

NServiceBus is an exceptional framework for rapidly building enterprise applications. Not only was it easy to use out of the box, but the documentation was great and the large user community was very responsive. We were up and running with a prototype in a week.Manoj Oswal, VP - Structured Notes, Tier 1 Investment Bank

Protect mission-critical data

There's an obvious, often unspoken rule in the financial industry: don't lose people's money.

In terms of financial systems, that translates to: don't lose data. But if you build a distributed system based on HTTP calls over RPC (i.e. REST), you run this risk with every call. If the call fails, the data is gone.

Even worse, what if an unreliable network causes an HTTP request timeout? Did the server successfully process the request, but then time out while sending the response? Did the server never receive the request in the first place? There’s no way to know.

In a financial system built with NServiceBus, your data is recorded immediately to a message in a queue, where it is safely stored to disk. If anything fails while it is being processed—if a server crashes, if the database is down, or if a third-party service fails—the message goes back to the message queue and waits to be processed again.

When your data is kept safe, it can save money, prevent lawsuits, and keep you focused on what matters: delivering value.

Designing your processes with the Particular Service Platform means when one step in the process fails, it will automatically get retried. No more late-night phone calls about failed batch jobs.

Watch this video for a better picture of how failures can lead to losing financial data or other critical customer data, and how using NServiceBus will keep that data safe.

Integrate easily with external systems

Financial systems don't operate in a vacuum. Often, a workflow requires interaction with several external services, such as tax authorities, insurance companies, credit bureaus, property inspectors, and regulatory offices, and often with other internal systems. Coordinating a complex workflow between these systems can be a lot to wrap your head around, especially when you need to worry about SLAs and what to do when a service is down in the middle of a process.

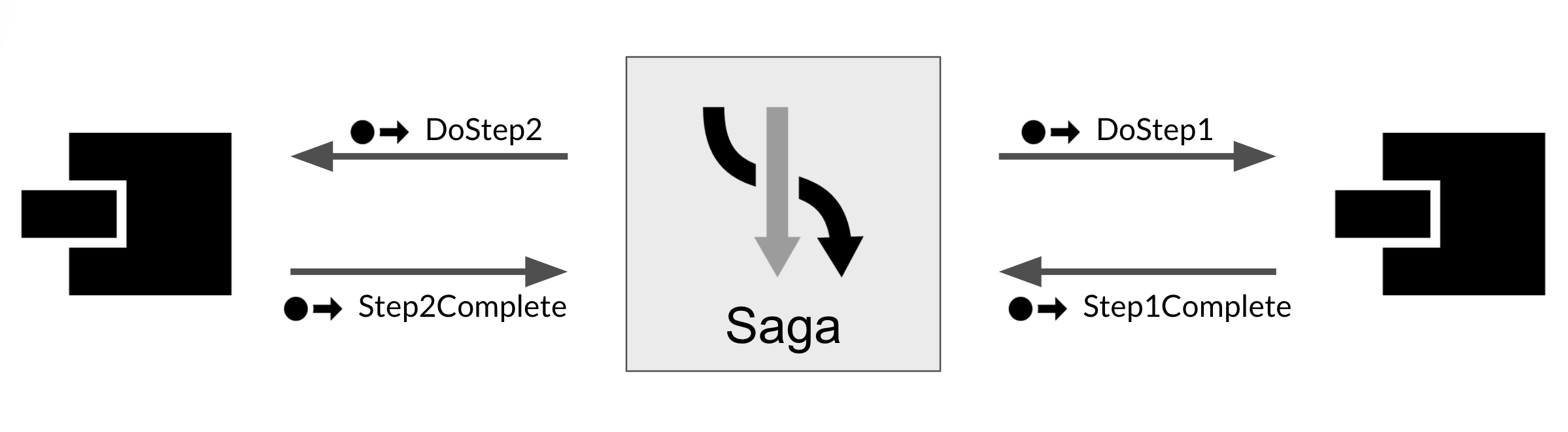

With NServiceBus sagas, you can easily manage complex workflows that involve integration with third-party services. Think of a saga as a message-driven state machine that takes messages in, makes decisions, and sends messages out to other handlers for processing. It's a simple, but powerful concept.

Consider a mortgage application where you need to contact a credit bureau, a property inspector, and an insurance company. In our saga, we receive a request to process a mortgage application. As part of the process, we send out messages to two different handlers: one to do a credit check, another to arrange for a property inspection. The credit check handler responds with an approval and at that point, the saga checks to see if the property inspection has been done. It hasn't, so the saga goes back into a holding pattern until it has.

When a message arrives that the property inspection is done, the saga wakes up and checks if both the property inspection and the credit check are done, at which point, they are. Since all conditions are met for the next stage, which is to find an insurance company that will underwrite the mortgage for us, the saga sends another message and the workflow continues.

This is a simple example but it gives you an idea of how a saga can coordinate multiple services. In addition to the happy-path scenario presented here, sagas can also be used to handle any deviation from the normal expected sequence of events. What if there's no response from the property inspector within the required SLA? Saga timeouts can be used like an alarm clock so that the workflow can continue, even without an external trigger. Did the credit check come back with a rejection? Publish an event, and another process can send an appropriate message to the sales department so they can decide how to proceed with the mortgage application.

With NServiceBus sagas, these concepts are expressed as code. That means the complex business logic can be verified with unit tests, even when modeling the passage of time. You're in total control, every step of the way.

React in real-time

In the "old days", people would make payments with their checkbook and track their current balance in their check register. Then, once a month, they would receive a statement from their bank in the mail, and balance their checkbook by reconciling all of the purchases made with line items from the bank statement.

Not so much anymore.

Today, customers expect instant access to their account data from the web and a mobile app, with up-to-the-minute updates on recent transactions and account balances.

So it is across the finance industry. Real-time services like Fedwire and TARGET have been around for decades but only recently have customers started demanding the same across all products and services. The push to be real-time in personal banking, mortgages, lending, and securities trading is ever-present.

- Often the company to win a mortgage will be the first to reach out to a prospective borrower with a rate quote.

- Trading platforms need to react quickly to changing market data in order to make the most out of invested capital.

- Customers want wire transfers to be executed quickly, but regulations require due diligence and internal approvals.

- …and the list goes on and on.

Making things truly real-time in an industry still reliant on mainframes and flat file integration is definitely a challenge, but using message-based processing with NServiceBus can help to close those time gaps to near zero.

Using the publish/subscribe pattern, events that occur in one part of the system can trigger other processes immediately, rather than at the next execution of a batch job. This makes loosely related processes execute on demand, without suffering from the coupling that comes from tightly orchestrating the steps in the process. This makes it easier to evolve the business processes later.

Also, using NServiceBus sagas makes it possible to model time by requesting a timeout message to act as an alarm clock to take an action at some time in the future. This lets you take scheduling to a very granular level, down to each entity like an account or mortgage. Instead of checking every entity for some condition every night, each entity sets its own timeout for when the next action needs to occur. When the timeout is due, the process wakes up and makes decisions for that specific entity in real-time.

By breaking processes down to discrete messages and message handlers, the wait time between processes shrinks, so that everything that used to involve a lot of waiting happens instantly.

For more about this scenario, see our blog post Death to the batch job.

Be flexible in the face of complexity

Finance is one of the most complex industries in existence. Ever since the invention of fiat currency, the vast array of things humans can do with money has been limited only by our imagination. Unfortunately, that also means virtually unlimited possibilities for exploitation by bad actors. As a result, finance is also one of the most regulated industries in existence, in order to combat fraud and money laundering.

In financial systems, complexity starts with the various ways in which money can be manipulated. It grows due to regulation added to prevent abuse, and is compounded by the number of integrations, both standard and proprietary, that must be implemented to ensure compliance with those regulations.

Programs such as Know Your Customer (KYC), the Customer Identification Program (CIP) provision of the USA Patriot Act, customer due diligence, and enhanced due diligence are all regulatory challenges that software systems in the financial services industry must overcome. Of course, there are external vendors for all of these services, but then integrations need to be built that can reliably reach out to these vendors and then orchestrate the results.

NServiceBus sagas help by defining complex business processes as message-driven state machines. Sagas passively wait for incoming messages and then take action when conditions are right, or they can take control and orchestrate processes by stepping through a workflow. Regardless, the logic defined in an NServiceBus saga can be easily tested, so that when business logic needs to change, we can be sure the business process won’t fail.